Penalty Relief from the IRS Due to Reasonable Cause

Penalty Relief from the IRS Due to Reasonable Cause You’ve made every effort to fulfill your obligations to the IRS, and yet, you find yourself

Penalty Relief from the IRS Due to Reasonable Cause You’ve made every effort to fulfill your obligations to the IRS, and yet, you find yourself

Penalty Relief From the IRS for Failure to File You pride yourself on always filing and paying your taxes on time. Unfortunately, even the most

Penalty Relief from the IRS For Underpayment of Taxes Filing your tax return may feel like a once-a-year fiasco, but your interactions with the IRS

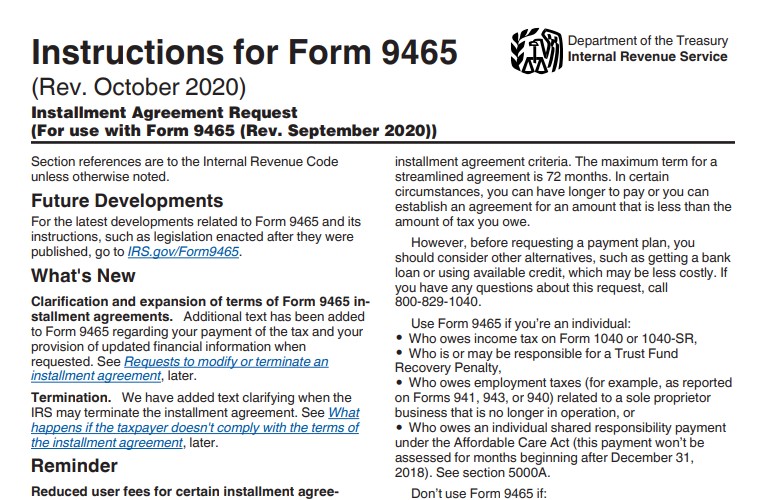

You’ve done the hard work of establishing an installment agreement with the IRS. Now, your goal is to finish paying your installments — and to

The IRS offers numerous options for fulfilling your tax obligations via installments. The agency clearly favors direct debit, and for good reason: this improves the

Filling Out IRS Form 9465 for an Installment Agreement: What You Need to Know If you’ve considered resolving your tax debt with an IRS installment

The IRS provides several solutions for dealing with tax debt. Unfortunately, these aren’t always as easy to obtain as the agency would have you believe.

Take This Quiz to Find Out if an Offer in Compromise Is a Smart Decision for Your IRS Debt The IRS offer in compromise (OIC)

Can You Get a Second IRS Offer in Compromise If You Had One in the Past? Navigating the IRS offer in compromise program is never

Using the IRS Offer in Compromise Pre-Qualifier Tool: How to Interpret the Results The IRS offer in compromise can be a wonderful solution for putting