Shocked By How Much You Owe the IRS? How to Deal With the Psychological Ordeal And Make a Plan

You never look forward to tax season, but typically, you have a basic idea for how much you’ll owe and what you can do to

You never look forward to tax season, but typically, you have a basic idea for how much you’ll owe and what you can do to

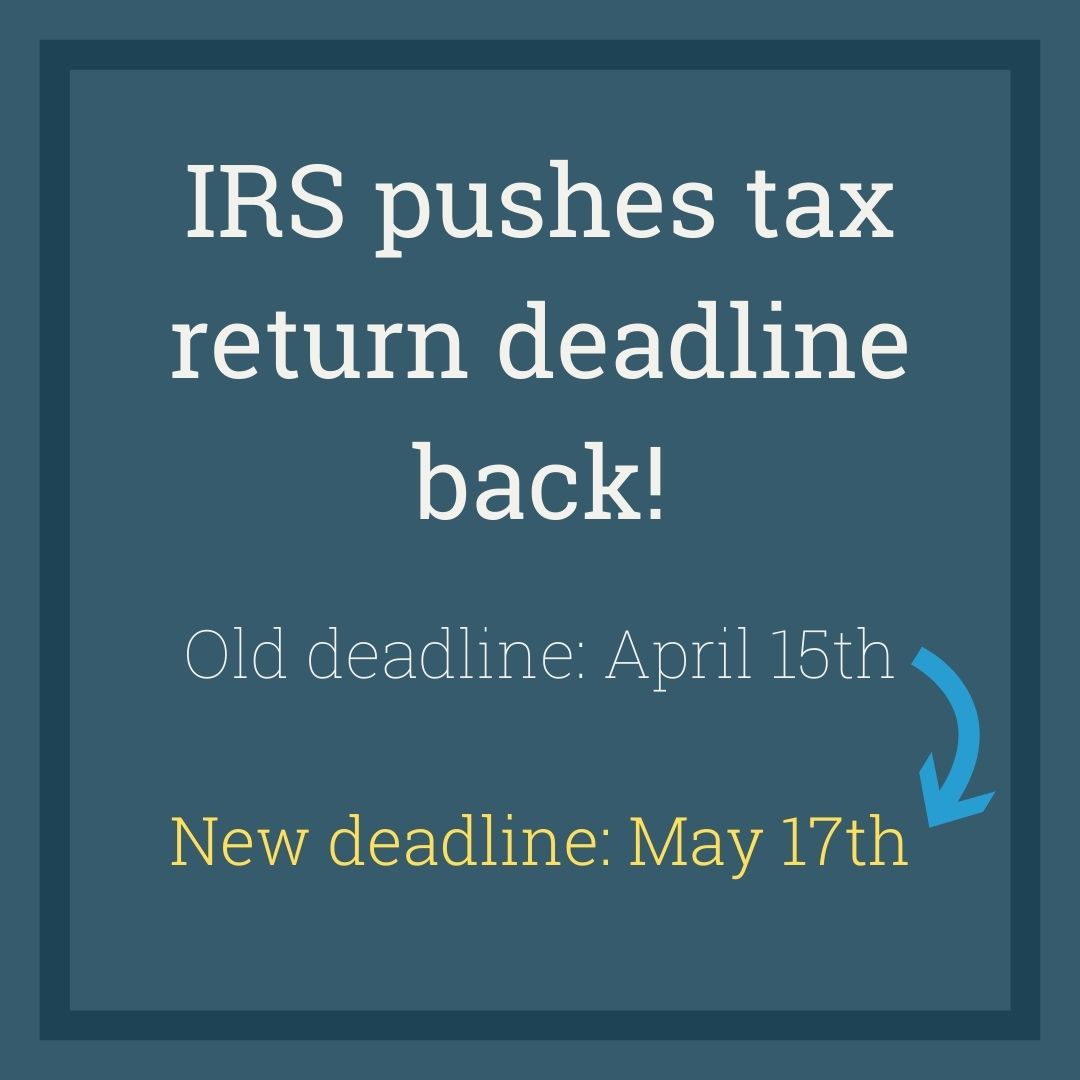

Great news for taxpayers, the IRS has extended the deadline for filing 2020 taxes from April 15th, 2021 to May 17th, 2021. This will give

IRS Payment Plan When your tax debt is more than you can pay at once, setting up a payment plan with the IRS is the

Borrowing to Buy a Residence When Subject to a Tax Lien One of the more extraordinary powers one can wield to improve one’s life is

Selling a Mortgaged Property When Subject to a Tax Lien Life goes on, even when you are subject to an IRS or other state or

Nothing complicates a financed real-estate transaction quite like an IRS or other tax lien. Real-estate transactions involving a mortgage are complex enough, even when they

You’ve made every effort to settle your tax bill, but you just can’t achieve a positive standing with the IRS. Collections could be in your

Currently not collectible (CNC) status can provide much-needed relief for taxpayers who are desperate for a break from the stress of tax debt. This approach

Unemployment claims increased sharply in January, 2021, with COVID surges prompting additional lockdown measures and accompanying economic instability. In the midst of all this financial

The economic struggles of 2020 have caused enough stress already, but this can quickly be amplified if you expect to pay in when tax season

2956 Wyandot Street

Denver, CO 80211

Privacy Statement | Disclaimer

Highland Tax Resolution © 2024.

All Rights Reserved. Web Design by Connective