How to Approach the IRS Offer in Compromise

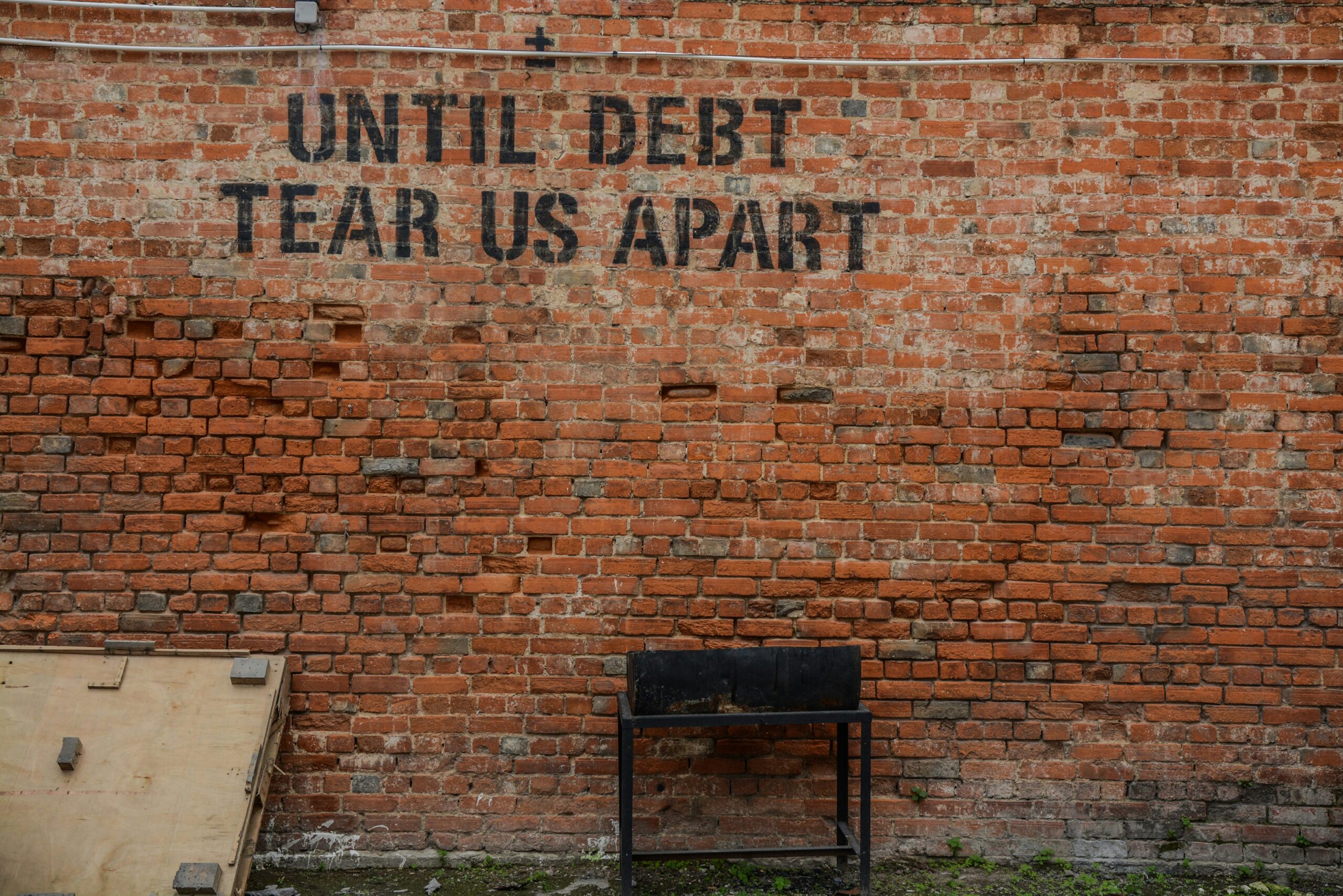

Taxpayers facing a significant tax bill they cannot afford to pay in full may be able to participate in the IRS Offer in Compromise (OIC)

Taxpayers facing a significant tax bill they cannot afford to pay in full may be able to participate in the IRS Offer in Compromise (OIC)

Navigating the tax landscape is complicated. If you get hit with a tax bill you’re unable to pay, you may need to fill out IRS

After receiving additional funding as part of the Inflation Reduction Act, the IRS has been beefing up its workforce by hiring thousands of additional agents.

After most of the Covid-19 pandemic was spent taking a backseat, IRS debt collectors are back and more aggressive than ever, as they issue IRS

The IRS is resuming its IRS debt collection processes. More extensive unemployment checks, tax credits, and a pause in tax debt collection are just a

The Covid-19 pandemic was rough financially for many Americans, leading the IRS to offer some leniency regarding IRS debt collections. Those with overdue taxes probably

For individuals and businesses facing IRS debt, exploring every option for settlement, such as an offer in compromise, is crucial. One of the primary means

Navigating complex tax laws is fundamental to any small business, but each remains open to an IRS audit at any time. Understanding the process and

Facing an IRS audit on your business tax return will involve thoroughly examining your financial records to verify accuracy and compliance with federal laws. Early

Thanks to the coronavirus pandemic, the cost of almost everything has gone up, including hiking equipment (don’t ask me how I know). With higher prices