Can I Switch from an IRS Payment Plan to an Offer in Compromise?

Finding a way to settle your tax debt can feel like navigating a steep, unfamiliar trail, especially if you’re already on an IRS installment agreement

Finding a way to settle your tax debt can feel like navigating a steep, unfamiliar trail, especially if you’re already on an IRS installment agreement

Missing a payment on your IRS installment agreement can be unsettling. Luckily, the situation is manageable if you act quickly. Here’s what to expect and

When you’re staring down a tax bill from the IRS, the stress can swallow you whole. For many taxpayers, an installment agreement offers a good

When it comes to paying IRS tax penalties and fees, many taxpayers simply throw up their hands in surrender, believing that there is nothing they

We’re entering the new year and first quarter on a high note concerning IRS interest rates – but whether that’s a good or bad thing

The IRS offers numerous options for fulfilling your tax obligations via installments. The agency clearly favors direct debit, and for good reason: this improves the

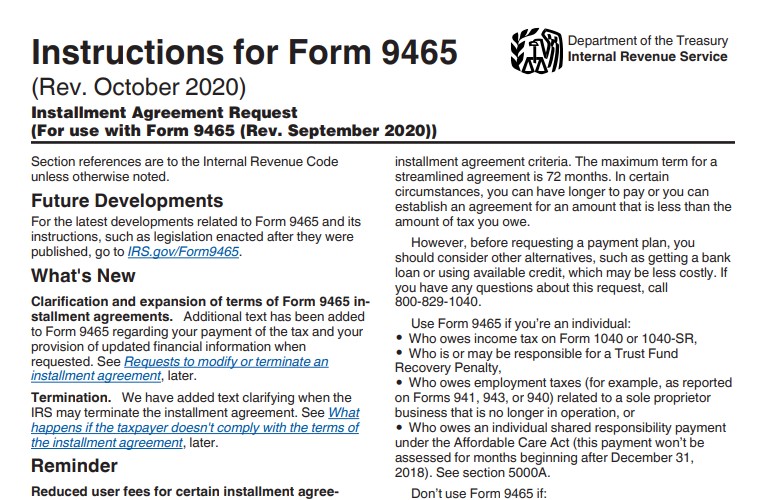

Filling Out IRS Form 9465 for an Installment Agreement: What You Need to Know If you’ve considered resolving your tax debt with an IRS installment

The IRS provides several solutions for dealing with tax debt. Unfortunately, these aren’t always as easy to obtain as the agency would have you believe.

Forced to Add to Your IRS Debt This Year? Do’s And Don’ts For Restructuring Your Installment Agreement Digging yourself out of an IRS tax debt

What You Need to Complete IRS Form 9465 — The Installment Agreement Installment agreements are among the most common solutions for dealing with IRS debt.