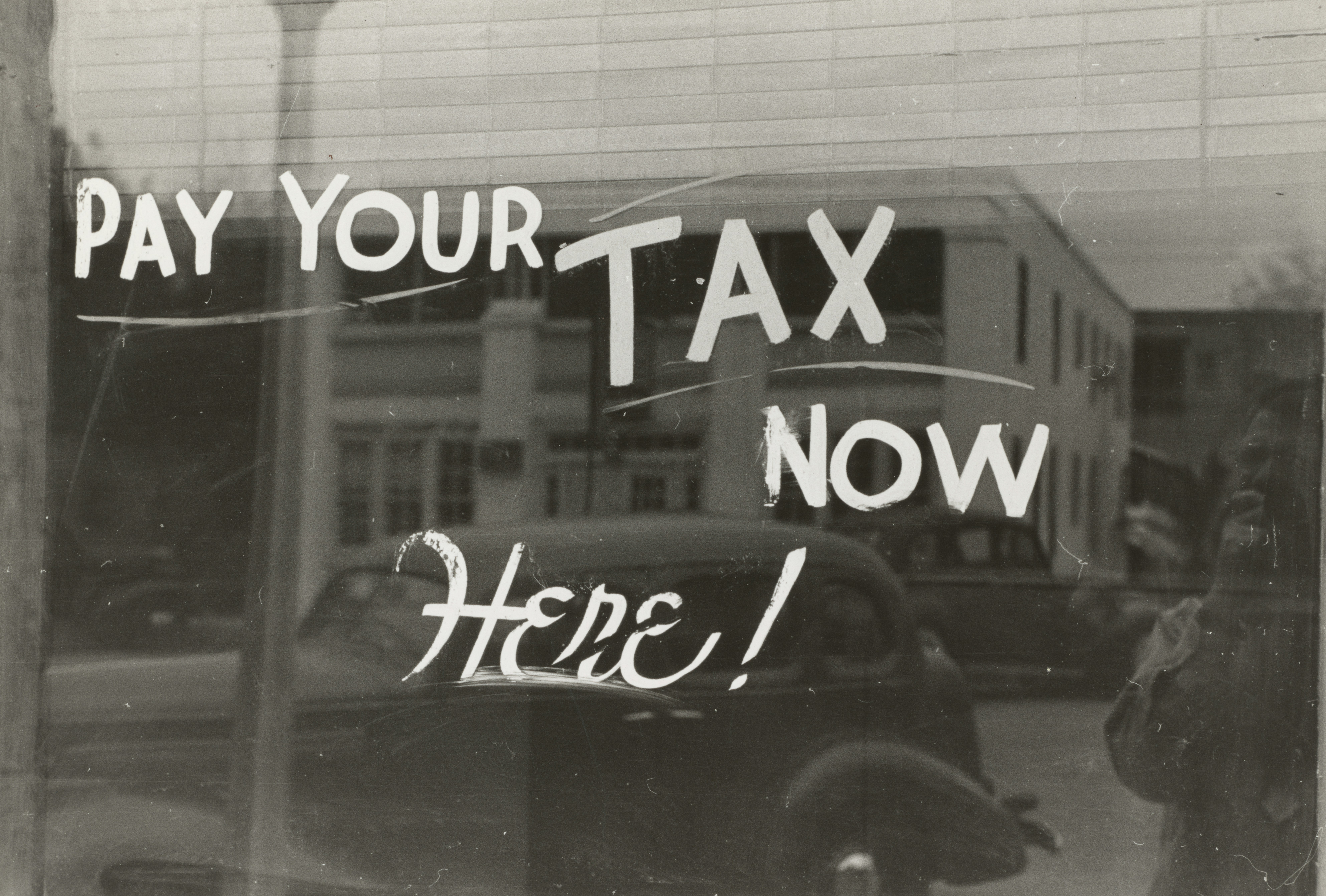

Myth # 3: You Don’t Need a Plan to Resolve Your Debt—Only a Willingness to Fight the IRS Tooth and Nail

You may have heard that fighting back can buy time or reduce your IRS debt. But battling the IRS instead of formulating a realistic plan

You may have heard that fighting back can buy time or reduce your IRS debt. But battling the IRS instead of formulating a realistic plan

Perhaps you think the IRS will be desperate for you to make a payment and eager to accept a simple resolution, but this is far

When you’ve gotten far behind on your taxes, the debt can feel even more insurmountable than the first year you could not pay. As an

For the IRS, an Offer in Compromise strategy is a last resort. They will consider granting this relief only if you’ve exhausted all other options

After the Covid-19 pause, the IRS has roared back to life. The agency now has increased funding, and delinquent taxpayers may find an agent at

The Wall Street Journal recently reported that as of the end of 2022, there was an increase (from 2019) of nearly 2 million additional individual

In December, the IRS announced they would offer about 4.7 million taxpayers penalty relief for back taxes. Most of the impacted individuals make under $400,000

The IRS is resuming its IRS debt collection processes. More extensive unemployment checks, tax credits, and a pause in tax debt collection are just a

Thanks to the coronavirus pandemic, the cost of almost everything has gone up, including hiking equipment (don’t ask me how I know). With higher prices

An Offer in Compromise (OIC) is a way to resolve your tax debt for less than the total debt amount. It’s available to those who