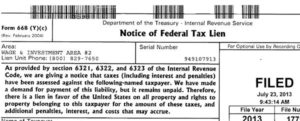

A federal tax lien is the government’s claim against your property if you fail to pay or otherwise ignore a debt. A tax lien only occurs after the IRS assesses your liability and sends you a bill for how you much you owe–but you neglect to pay the bill in time.

The best way to get rid of a tax lien is to pay your tax liability in full within 30 days. A continued lien creates several negative outcomes:

- It Can Crimp Your Cash Flow

The lien allows the government to garnish your wages or profits from your business. This action in turn limits your company’s ability to make new purchases, stock inventory, or carry on day-to-day operations. The cash flow crunch can hit home, too, preventing you from paying down credit cards, meeting child support obligations and purchasing household essentials.

- It Can Tarnish Your Credit

The IRS tax lien will be reflected on your credit report, possibly lowering your score significantly and preventing you from qualifying for important business and personal loans. Many potential creditors will see your lien as a big red flag—an indicator that you will not pay back what you owe. Depending on the nature of your other debts and your credit history, you may need to invest months of effort to restore your score.

- It Can Sour Relationships

Trust is an essential professional currency. When your business fails to fulfill obligations to clients, suppliers, vendors or employees—because the IRS is siphoning away a sizable share of your revenue—the consequences tend to be anything but pretty. Suppliers and vendors could take legal action to collect. Angry clients might become ex-clients. Loyal employees will have to explain to their own families why there’s no check—because you can’t make payroll thanks to your IRS challenges.

Meanwhile, on a personal level, a tax lien can provoke deeply emotional household arguments about finances. In fact, money is the leading cause of stress in relationships.

Fortunately, you can mitigate these risks by addressing your federal tax liability intelligently. If you’re dealing with an IRS tax lien—or worried that you could be facing one soon—we can help. We’ll develop a strategic plan to solve your issues and relieve the stress. Call us now at 720-398-6088!