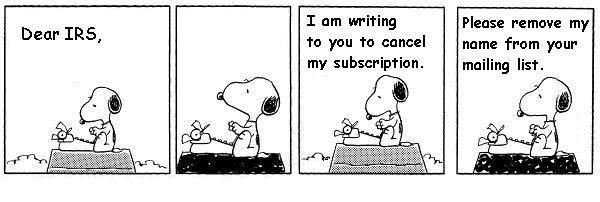

The IRS collections department is notoriously stressful and confusing. If you have received a series of notices from the IRS collections department, it is imperative that you address them as soon as possible. Fortunately, there are plenty of options for paying back owed taxes and avoiding levies or liens. Keep reading to learn more about the IRS collections department:

1. The process does not involve threatening phone calls.

The IRS alerts you to impending collections via a series of notices sent through the mail. These include CP14, CP501, CP503, and CP504. If you receive an aggressive phone call from the IRS before receiving one of these notices, it is most likely a scam. Be wary of phone calls.

2. The IRS can issue a variety of levies.

Depending on your situation, the IRS collections department may attempt to recover owed taxes through seizing bank account money, garnishing wages, garnishing self-employment income, or assessing a lien on your home.

3. There is a penalty for filing an extension and paying late.

Some taxpayers who owe money fail to file extensions because they assume they’ll be assessed significant fines. However, if you file an extension, and pay your taxes by with the extension filed on April 15th, you will not incur a fee. If you make late payments with an extension, and file on October 15th, however, you may be assessed a large penalty.

4. You can remove liens with the IRS Fresh Start program.

The prospect of paying tax liens can be stressful, but it can be made more manageable with the help of the IRS Fresh Start program. If you enter into a debt repayment program, you may be eligible for a lien withdrawal with the IRS collections department.

5. You may be eligible for uncollectible status.

If the IRS collections department determines that you are incapable of paying owed taxes due to current financial hardship, your case may be deemed “currently not collectible.” Keep in mind, however, that interest and penalties will continue to accrue, and a tax lien will be filed, even if collection does not take place.

6. The IRS can now revoke passports.

The consequences of not paying your taxes can extend beyond finances to include travel. The recent FAST Act gave the IRS the power to revoke or deny passports in some cases.

Call Our Office

Whether you face a levy or some other adverse tax situation by the IRS collections department, you can benefit from legal guidance. Feel free to reach out at 720-398-6088.