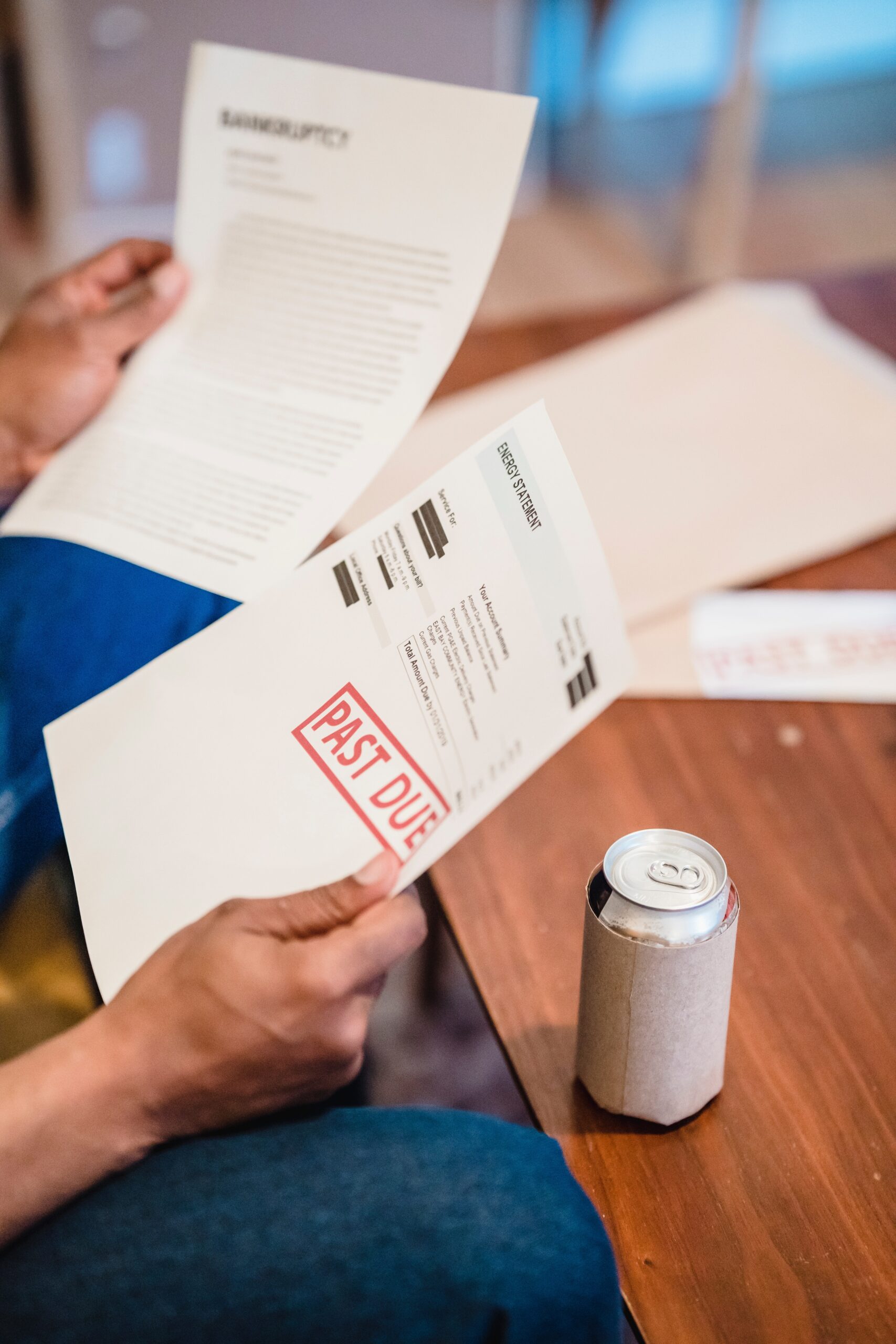

The Worst IRS Notices and Letters and What to Do if You Get One

It is a scary thing to receive a notice or letter from the Internal Revenue Service (IRS). Still, not all IRS letters are negative, as

It is a scary thing to receive a notice or letter from the Internal Revenue Service (IRS). Still, not all IRS letters are negative, as

You may have recently received an IRS notice that you have a “seriously delinquent” IRS tax debt. What distinguishes a “seriously delinquent” debt? It must

The Internal Revenue Service (IRS) uses an identity verification and sign-in process to enable taxpayers and tax professionals to securely access and use IRS online

If there is an issue with your federal income taxes, the IRS, in most cases, will send you or your designated representative a written IRS

The IRS is not well known for stellar communication, specifically when it comes to issuing IRS notices or communications. Historically, the agency has relied, for

The United States operates on a pay-as-you-go tax system. The IRS requires small businesses and self-employed individuals to pay their estimated quarterly taxes. Instead of

If the IRS seizes your property by way of an IRS levy, it can be frightening. The entire process can be overwhelming, even if you knew it

During the Covid-19 pandemic, the Internal Revenue Service launched its People First Initiative (PFI) to help ease the burdens on taxpayers. The PFI aimed to

Curious about which IRS Tax Crimes can land you in prison? They say that the only sure things in life are death and taxes. It’s

Although it’s sometimes necessary to delay your plans due to unforeseen circumstances, you can face real problems when delaying your taxes. You must understand the