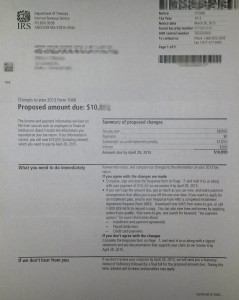

Have you received a notice claiming you owe the IRS a vast sum of money? Did the IRS notice leave you feeling confused, frustrated, angry, and not knowing where to turn? Well, look no further, as Highland Tax Group, Inc. offers effective solutions for dealing with not only IRS notices, but also IRS Tax Audits. Also known as IRS Letter CP2000, (Pictured below) the letter indicates you owe the government and the IRS is making changes on your tax return!!

Fortunately, we have effectively represented hundreds of clients saving them tens upon thousands of dollars over the course of the past 14 years. The IRS is usually wrong when they send out the IRS Tax Audit notices, yet they collect MILLIONS every year from taxpayers just like you. NBC did a great article on this subject alone. Click here to read more. As of yesterday, we effectively represented a client and his wife in an IRS Tax Audit for tax year 2014.

Below are some more details about effective representation during and IRS Tax Audit:

- It is imperative to have a copy of the tax return as originally prepared with all corresponding schedules for the tax year in question

- It is important to also have copies of all 1099’s, W-2’s, and as many of the tax documents used to prepare the return

- Of course, you will want to make a copy of the IRS Tax Audit notice to be sure you can reference the notice (ALL PAGES)

- Compare the changes to your original return; did your return include the figures on the IRS letter, is the IRS letter incorrect?

- Prepare a challenge or protest to the IRS Tax Audit

- And lastly, if you are having trouble, don’t have the time or expertise, or are simply too frustrated to deal with the problem, call Highland Tax Group!

Our clients called us late last week in a panic, claiming they owed the IRS $28,0o0! We asked what the IRS was looking for and the clients explained the IRS was looking to change their tax return for 2014. This didn’t make sense as they included several of the figures the IRS was claiming they had not listed, on the actual return. Immediately we knew it was a IRS Tax Audit (Correspondence Audit, or CP2000) and I asked them to send me the notice. Upon review, we knew what we had to do to fight the IRS. The clients hired us this week and we have already called the IRS and were successful in reversing the changes from $28,000 to $1,000 in tax due. The client couldn’t be more pleased with the results.

If you or someone you know is undergoing an IRS Tax Audit, or receives an IRS notice they may be confused by, please let us know. We can be reached at 720-398-6088.