Tax Mishap or Tax Mistake? Failure to File IRS Form May Cost Grandmother Millions

A Tax Mistake that has wound its way to the United States Supreme Court has many observers wondering if a filing requirement in the tax

A Tax Mistake that has wound its way to the United States Supreme Court has many observers wondering if a filing requirement in the tax

The IRS currently faces a huge backlog, causing major frustration for taxpayers waiting on refunds, offers in compromise, and other tax concerns, along with IRS

Yet Another IRS Backlog: What Challenges Does This Create in 2021? Are you frustrated by the slow response from the IRS this year? You’re certainly

You’ve completed your tax return and are shocked to discover that you owe the IRS a hefty sum, and are trying to decide, state versus

You’ve been subjected to an IRS levy, and now, you’re dealing with collection efforts and the opportunity to utilize form 9423. These can be both

You’re dealing with tax debt and worried about penalties from the IRS. The thought of an IRS levy deduction from your pay has likely crossed

Once you find yourself indebted to the IRS, it can feel like a Herculean effort to dig yourself out and pay off IRS Installments. Even

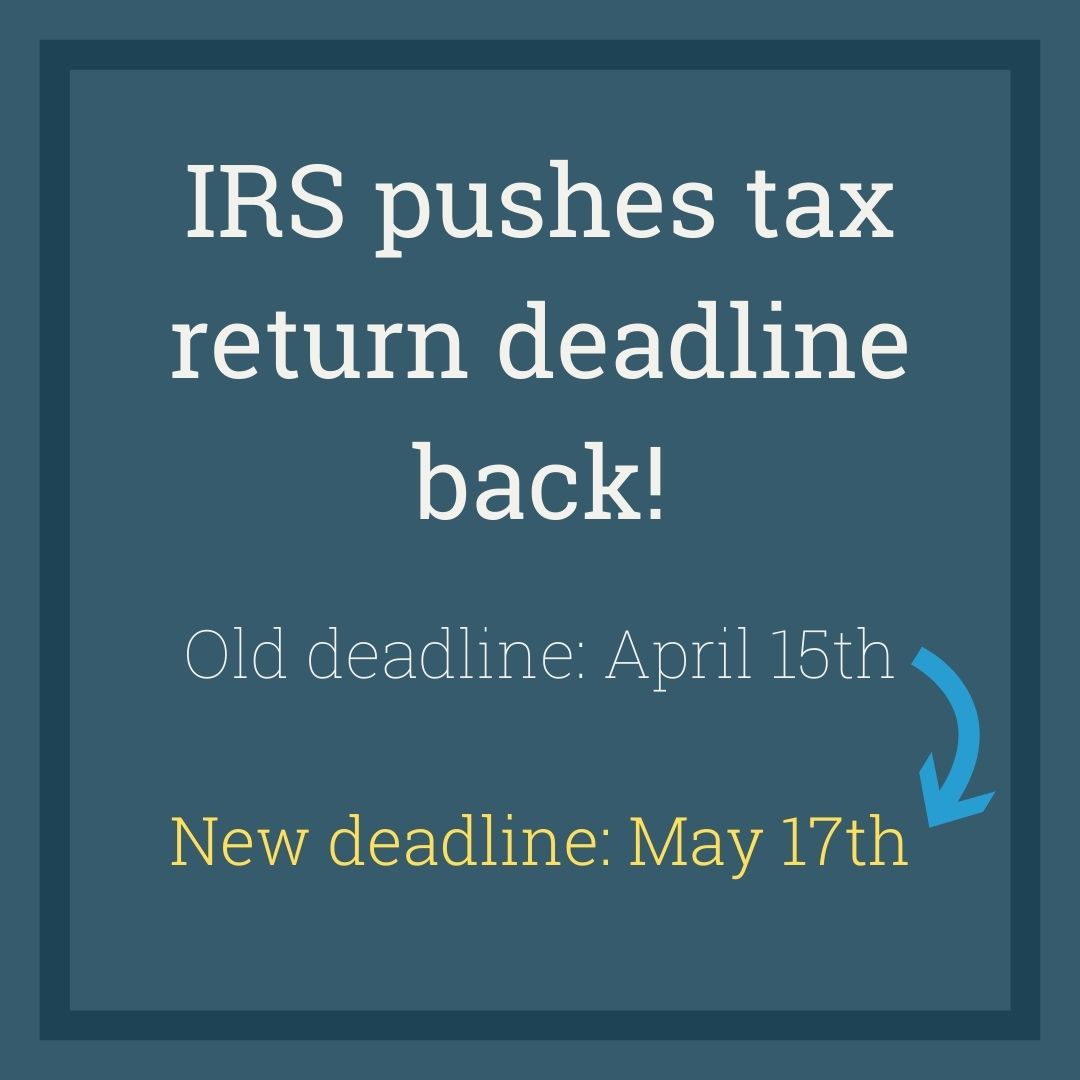

Great news for taxpayers, the IRS has extended the deadline for filing 2020 taxes from April 15th, 2021 to May 17th, 2021. This will give

With 2020 finally in the rearview mirror, you’re ready to start fresh. Not all obligations attached to 2020 are out of the way, however. Your

Filing taxes is always stressful, but 2020 brought all kinds of new challenges. Given the complications of COVID, quarantine, and the stagnant economy, filing may