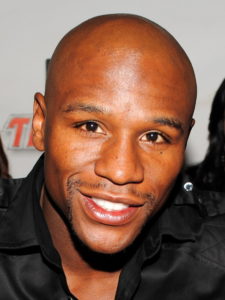

The tax woes of Floyd “Money” Mayweather made their way into the spotlight earlier this summer, as ESPN reported that the undefeated professional boxer has a lien from the IRS in the amount of $7.2 million for taxes owed from 2010—in addition to $22.2 million he allegedly still owed in taxes for 2015, for the $200 million payday he received from a match with Manny Pacquiao.

According to ESPN, Mayweather’s attorney said the IRS lien for 2010 taxes is “invalid,” and Mayweather filed a petition stating that he didn’t have enough liquidity to pay his 2015 taxes, but he would have a “significant liquidity event” with his fight with Irish MMA star Conor McGregor. The IRS denied the boxer’s offer to pay installments until he received his payday from the fight, pledging to place a levy on the boxer’s assets.

Additionally, CBS Marketwatch had learned that the IRS took “the position that Mayweather has considerable current financial assets that could be sold or borrowed against to pay all or a portion of the back taxes owed now.”

The bout took place August 26, and The Blast reported that, on October 5, the boxer did use his winnings from the fight to settle his remaining tax bill.

ESPN says this run-in with the IRS isn’t Mayweather’s first.

“It’s the latest in a cycle for Mayweather,” said ESPN, “who paid $15.5 million in taxes for 2001, 2003-2007 and 2009 only after the IRS filed liens against him, according to documents filed to the Clark County Recorder in Las Vegas.”

While most of us don’t deal with tax bills nearly as large as Mayweather’s, large paydays can cause you problems with the IRS if you don’t pay your taxes off the top, especially if you are self-employed. And larger tax bills of $100,000 or more can often result in liens and levies, seizure of assets, etc.

Mayweather’s immediate tax issues seem to be resolved for now, but there are smarter ways to deal with larger back tax bills. To learn more about your options, call our offices at 720-398-6088 today.