You want to plan for your heirs, leaving them with a financial legacy and possibly even giving to charity upon your passing. But what if the economic downturn of 2007 and 2008 deeply affected you? Can you avoid leaving debt to your heirs? This blog will address what happens to your mortgage and credit card debt when you die, while the second part will cover vehicle loans, student loans, medical loans and IRS debt.

Mortgage Debt

If you are married, your spouse is probably on the loan and will continue making house payments unless he or she moves. If you leave the residence to your child or other heirs, or if they remain in the home, then they will be financially responsible as well. In order to help out family members if just one person’s name is on the mortgage, the Consumer Financial Protection Bureau has specific rules to protect you. However, someone will need to keep paying the mortgage, although he or she might consider refinancing the loan.

Your heir might opt to put the house up for sale, although it might be worth less than what is actually owed. The bank most likely will accept the sale amount to cover the balance due; however, it can access assets from the estate in order to pay off any deficit.

Credit Card Debt

Spouses who are joint-account holders will probably inherit your credit card debt. In addition, in community property states, all debt is considered common if it was incurred during the marriage. Therefore, your children will not be held personally liable for your credit card debt, but the estate could be forced to pay off the credit card if assets are available.

Heirs should be forewarned that debt collectors might try to talk adult children into paying off the credit card debts for a deceased parent. Legally, these companies cannot contact an heir, but they sometimes still attempt to do so.

Tax Debt

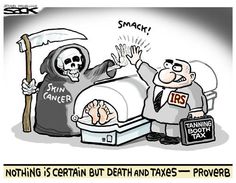

We will get into tax debt in our series of discussions in the upcoming weeks. After all, everyone knows there is two certainties in life; death and taxes.

Contact Us for Help

You might not understand your rights when it comes to debt after a parent’s death. If you are emotionally distraught, you might not feel ready to deal with financial issues. Call our team at 720-398-6088 for answers to your questions about how to deal with debt when a parent dies.