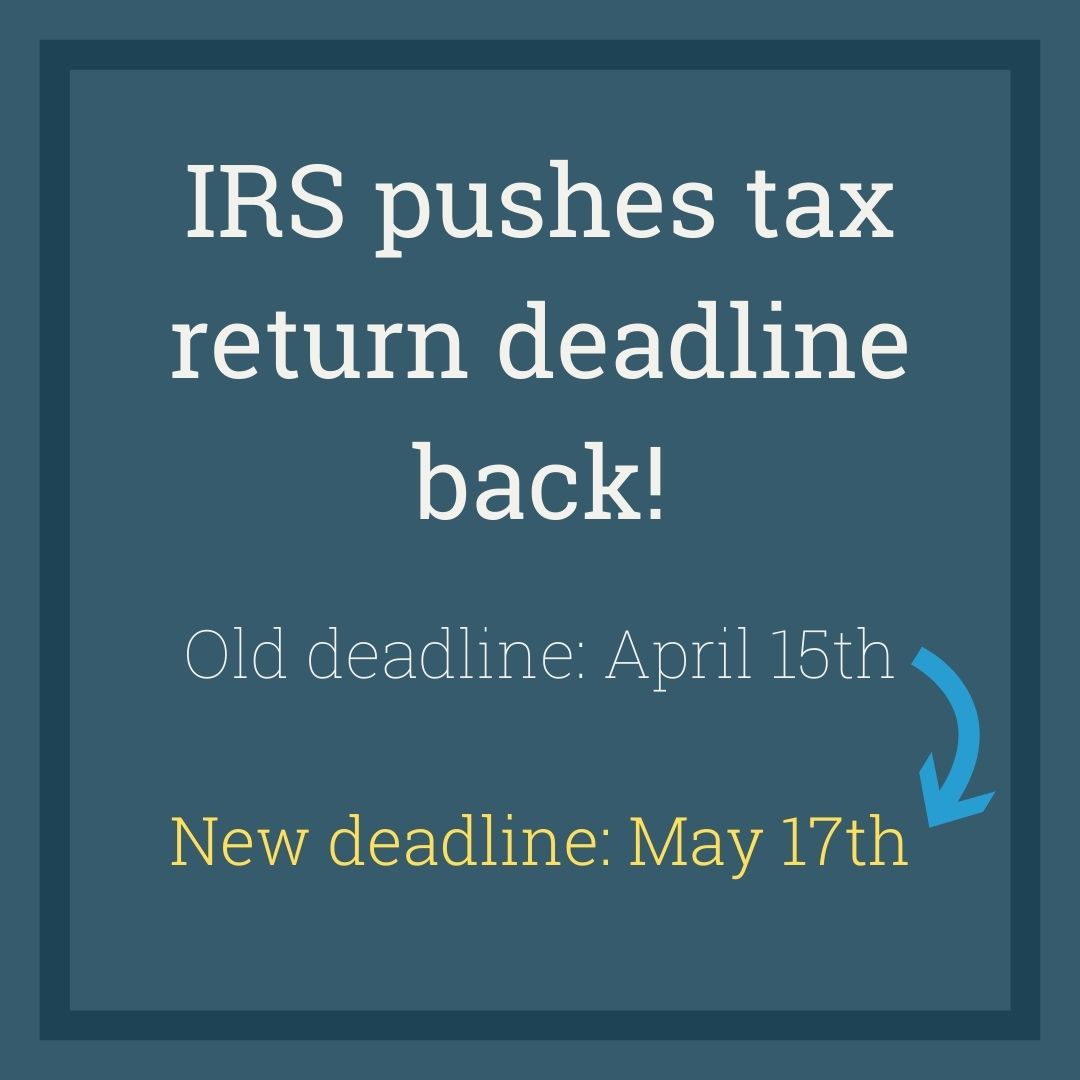

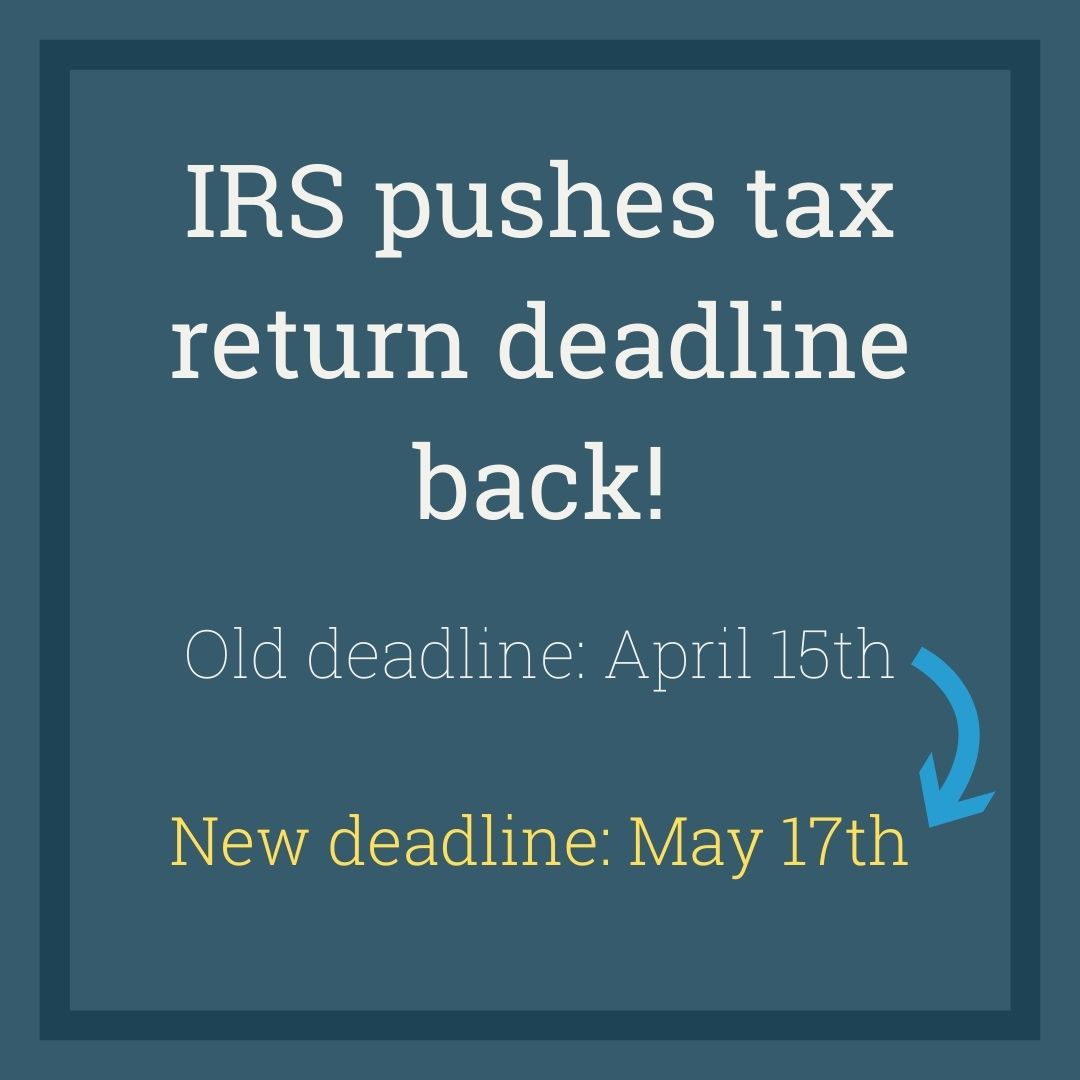

IRS Pushes Tax Return Deadline Back!

Great news for taxpayers, the IRS has extended the deadline for filing 2020 taxes from April 15th, 2021 to May 17th, 2021. This will give

Great news for taxpayers, the IRS has extended the deadline for filing 2020 taxes from April 15th, 2021 to May 17th, 2021. This will give

If you owe the IRS, have a payment plan, or have a business with tax liability, we know you’re already in a world of hurt.

We are monitoring the statements on Coronavirus (COVID-19) being issued by local health departments, the Centers for Disease Control and Prevention (CDC), and the World

America’s multi-tiered tax system, unfortunately, includes annual filings and payments at both the federal and state levels. While policies differ dramatically from one state to

Given the government shutdown, we thought we would keep things light today. Sometimes, the most responsible taxpayers mess up. Life can get in the way

If you always file your IRS taxes as soon as those W2s come in and then laugh at the procrastinators who hold back until April