The Internal Revenue Service uses two main approaches to recover owed taxes: IRS tax liens and IRS tax levies. Both actions can prove disastrous for taxpayers, but in different ways. If you owe taxes, and you are at risk of collection, it is important to gain an understanding of these tactics and how they may affect you.

Tax Liens

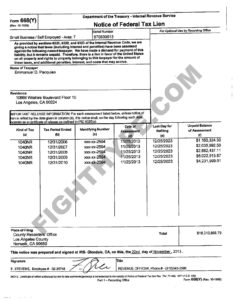

IRS tax liens do not actually involve seizure of property, but rather, a claim against your property. If you neglect to pay a bill from the IRS, you may receive a Notice of Federal Tax Lien, which lets creditors know that the government has the right to seize your property. Upon receipt of this notice, you have up to thirty days to file an administrative appeal

Liens are commonly associated with real estate. For example, if the IRS imposes a lien on your property, you may forfeit your ability to profit from home equity upon sale closing. Levies rarely involve real estate, but in some cases, the IRS may seize homes if granted court approval.

Tax Levies

A tax levy allows the IRS to collect on owed taxes by seizing your personal property and financial assets. Depending on your situation, this may involve garnishing your wages, seizing money from your bank account, or taking your car. The IRS does not have to file a Notice of Federal Tax Lien in order to seize property, but a Final Notice of Intent to Levy is necessary. As with tax lien notices, an appeal window of thirty days is provided.

Liens, Levies, and Your Credit Report

The prospect of losing property or equity is of chief concern to those threatened with levies and liens, but many find the possibility of a damaged credit report just as stressful. Notices of Federal Tax Lien are accessible to credit reporting agencies, and they may have an impact on your credit score. A levy, however, will not affect your credit report.

Call Our Office

If you believe you are at risk of incurring an IRS tax lien or IRS tax levy, it is imperative that you contact a trusted tax professional as soon as possible. The right advisor can help you halt the process and prevent seizure of your assets. To learn more, contact us today at 720-398-6088.